In this article, I want to emphasize how much wealth is destroyed due to taxes, and how much better off we would be if we didn’t have them at all. This is the lost prosperity that we have missed.

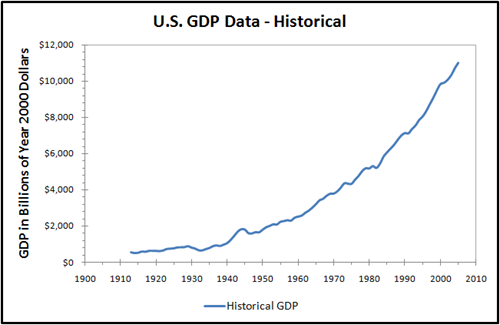

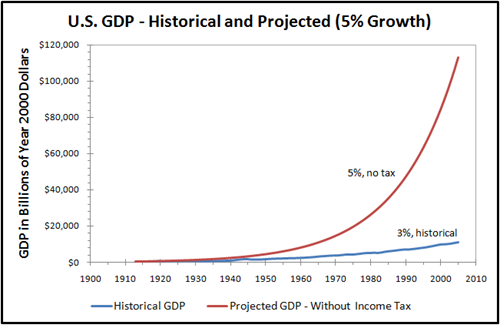

Let’s crunch some numbers. The average U.S. economic growth in GDP from 1913 to 2005 has been roughly 3% year to year. The next figure displays this in terms of Year 2000 Dollars (this allows us to take inflation into account). Recall that 1913 is the year the Sixteenth Amendment was ratified, which instituted the income tax.

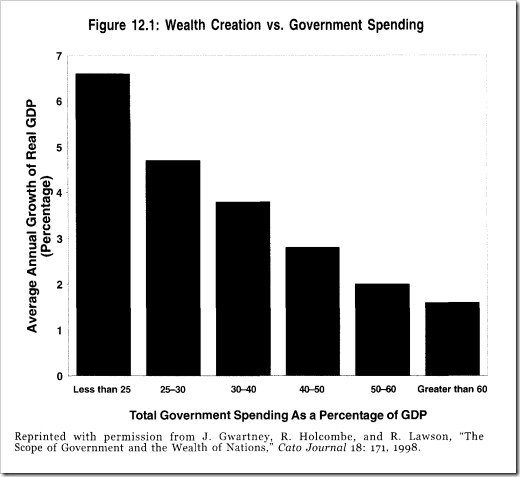

Upon inspection, one might say that this actually looks pretty good, 3% per year isn’t too shabby. However, substantial data that indicates that countries whose governments spend a greater percentage of wealth annually also experience diminished growth. I have scanned two graphs from Mary Ruwart’s Healing Our World (chapter 12) to help illustrate this. (Both are originally from Gwartney, Holcombe, and Lawson’s article entitled “The Scope of Government and the Wealth of Nations.”)

Note the trend in this first graph: the less a government spends its people’s wealth, the greater growth that nation will experience. This is correlated from hundreds of data points from various countries over time.

What is striking about this data is that as government spends ever less money, the rate of growth expands exponentially rather than linearly. In other words, a 10% reduction in government spending makes an even greater difference when moving from 25 to 15% total government spending (nearly 2% increase) than moving from 60% to 50% (about 0.25% increase).

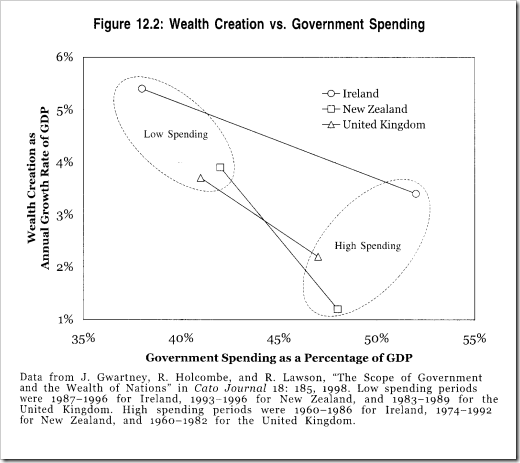

So, does this relationship hold in specific cases? In fact, it does. This next graph shows how Ireland, New Zealand, and the United Kingdom realized greater growth when they reduced government spending (data spans the years 1960 to 1996, see the caption).

Each of these countries had governments that spent greater than 45% of their annual GDP. Thus, each country experienced low economic growth, between 1 and 4%. These are the only three developed countries that made significant reductions in government spending between 1960 and 1996. One can clearly see that when each country reduced spending, their economic growth shot up significantly. In the case of New Zealand, their growth rate expanded three times over! Less aggression expands wealth.

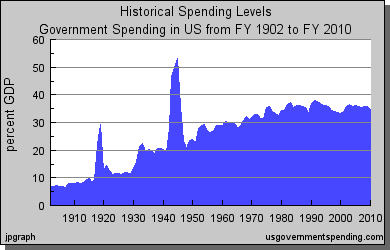

Think back to what you have learned in personal finance. Remember the concept of compound interest, that savings early on contributes to wealth expansion later? What is lost due to taxation is compounded over time. And when we consider what the United States government spends, the obvious conclusion is that we have missed an extraordinary opportunity. Over the last 100 years, the United States Federal Government has dramatically increased its consumption of annual GDP. You can readily see this in the next graph. Around 1915, the Feds spent only around 10%, and aside from the two gargantuan spikes (the World Wars), the general trend has been a steady increase to 35-40% of annual GDP. No wonder the economy is only growing at 3% in supposedly the most free nation on earth!

Now we are in the position to calculate the prosperity we have lost due to the income tax. It is actually a very simple calculation to make, if you make some simplifying assumptions.

In this case, I will assume no variation year to year in growth, and that the growth rate is 5% – only 2% above the current average rate. This is actually a conservative estimate when you think about it, because we would likely see upwards of 4-5% increase in annual growth if the income tax were eliminated as per the previously cited data. But for now, let’s call 5% the lower bound. Here’s what you get:

The difference between 3% and 5% growth is nothing short of startling. The conservative estimate is that we would likely be 8 to 10 times better off without the income tax, and that number would go up even further if the growth rate is greater. Can you imagine what could be done with this kind of prosperity? We are often amazed at what we can do and produce with modern science and technology and with the connectivity of the internet. But the difference we can anticipate with this much growth would likely dwarf what we see now. Most likely, by eliminating the aggression of taxation we would increase wealth creation somewhere between 3 and 18 times!

We have to realize that trade, the social mechanism of increasing our economic well-being, is a win-win proposition. By definition, when you and I agree to trade the fruits of our labor, we are implicitly agreeing that we are both better off by making the transaction. Conversely, government force is a lose-lose proposition. No one but the thief is made better off when coercion is exacted, and laws of nature do not change when the collector wears an IRS uniform and the spender is a government bureaucrat.

Those who argue that it is only through government that we will cure disease, help people out of poverty, and make this world a better place have not seen the data. Prosperity is what cleans up cities, gets people into jobs, and heals illness, and the government will always fail when it tries to intervene. Why? Because government only works by aggressing against its subjects, which unequivocally makes the subjects worse off.

How amazing that the world works in this way! We do not have to choose whether we will have either aggression and prosperity, or peace and poverty. Rather, peace and prosperity go hand in hand. Thank God, we live in a win-win world.

For now, however, we have little choice in the matter of taxes. We do the best we can to avoid as many taxes as possible and live in peace, because otherwise the strong arm of the State is waiting. Let us keep pushing back the State through persuading our fellow man of the evils of the State, trading peacefully, and working for positive change in our communities.

And the fight goes on…

To read more about the evils of taxation, check out my article series on LibertarianChristians.com, where this was originally posted.

Great post, Norman.

Thanks Michael!